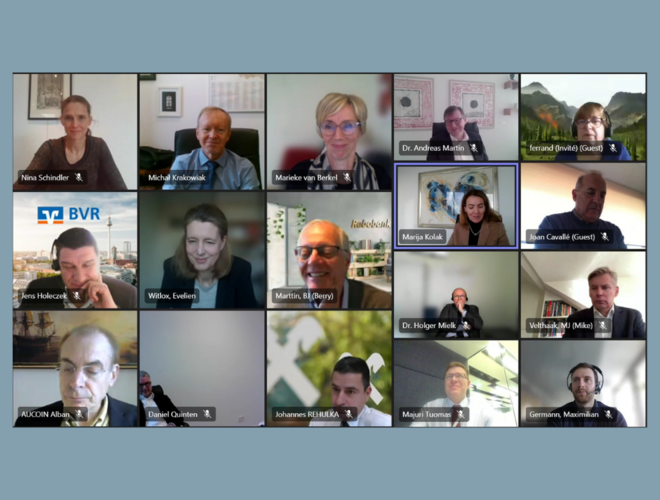

BRUSSELS, 16/12 - At the occasion of the 48th General Assembly, the members of European Association of Co-operative Banks (EACB) reflected with Ms Evelien Witlox, Programme Manager of the digital euro project at the European Central Bank (ECB), on the investigation phase of the digital euro project which started in July 2021. During the exchange with Ms Witlox, EACB members expressed their key concerns with the possible impact of a digital euro on the funding base of cooperative banks.

The ECB has started its reflection about launching a central bank digital currency in Europe to respond to the increasing demand for safe and trusted electronic payments. According to the ECB, having digital money issued by the central bank would provide an anchor of stability for the payment and monetary systems. A digital euro would also strengthen the monetary sovereignty of the euro area and foster competition and efficiency in the European payment sector. To support its reflections, the ECB launched a two year investigation phase in July 2021 which looks at how a digital euro could be designed and distributed, as well as the impact it could have on the market. Once concluded, the ECB Governing Council will decide whether to start the process of developing the digital euro.

Evelien Witlox highlighted “digitalisation is changing all our lives, almost no area is excluded from it. In particular, the way we pay is undergoing profound changes. The currency of us all, the euro, is not exempt from this. In the investigation phase we explore how a digital euro could ensure that also in this digital age residents can maintain direct access to central bank money and how to strengthen our strategic autonomy in retail payments. The project is progressing with great strides and is benefitting greatly from the input we receive from the frequent interactions with market participants. We envision the supervised intermediaries as the distributors for the digital euro. We are aware of the concerns that they might have and therefore have taken them explicitly onboard in the design decisions for the digital euro. We are looking forward to further exchange on this together in the remainder of the investigation phase”.

The EACB and its members fully appreciate the wish and the need for the ECB to discuss, reflect and research the idea of a digital euro. At the same time, there are concerns with some of the potential consequences. One of which is its impact on the funding base of cooperative banks, which – in particular for regional cooperative banks – is heavily reliant on deposits.

Berry Marttin, EACB President, stressed that “An outflow of deposits to digital euro accounts will impact the capacity of cooperative banks to meet prudential requirements and, by consequence, their capacity to continue what is their raison d’être i.e. to lend to the real economy. We therefore very much welcomed the insightful exchange we were able to have with Ms. Witlox today.”

Aside from the impact of a digital euro on the capacity of cooperative banks to meet prudential requirements, also see the question of where to land the digital euro as a means of payment as a crucial one. The payments market is a vibrant and competitive market full of innovative solutions developed by market participants. “Reflections on what is the right fit for the digital euro needs input from market participants. We sincerely appreciate and look forward to the continuing the dialogue with stakeholders that the ECB set up for this purpose” continued Berry Marttin.