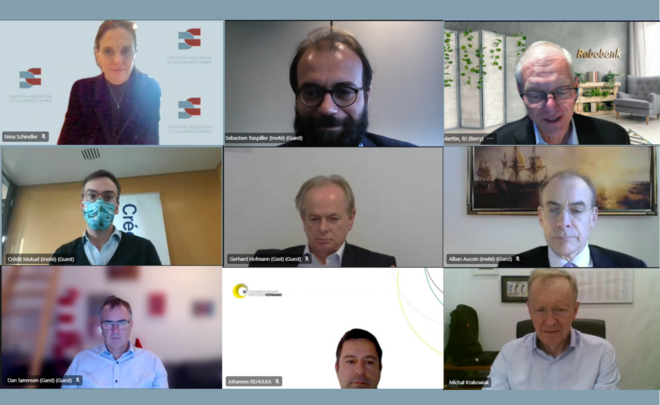

PRESS RELEASE - At the occasion of the 44th General Assembly, EACB members reflected with Sébastien Raspiller, Head of Service for the Financial Sector (Directorate General, French Treasury), on regulatory developments for the EU banking sector, particularly looking at central themes for co-operative banks. During these fruitful discussions, EACB members reiterated their key concerns on dossiers ranging from the implementation in the EU of the final set of Basel reforms, the completion of the Banking Union and the Corporate Sustainability Reporting.

The exchange came right ahead of the start of the French Presidency of the Council, which set ambitious goals. Particular attention also at Council level will be needed to ensure that the financing of the recovery of the EU economy remains on track. Members were happy to learn that the French Presidency campaigns for a diverse, strong EU banking sector in order to make the EU a powerhouse and that its key strategic projects can be financed.

Sébastien Raspiller highlighted that “a powerful and resilient European banking sector will help the European Union to complete its ambitions: enjoying a strong recovery, being fit for the digital age, and succeeding in its green transformation. Co-operative banks have an important role to play in this regard. We are committed to promote a pragmatic, output-driven approach during our Presidency in order to deliver on this agenda”.

In this context it was stated that the CRR-CRD proposals need to be carefully looked at to ensure that the banking sector can act in support of the EU strategy.

Berry Marttin, EACB President, particularly stressed that “the EU is the first major jurisdiction to unveil its plans to implement the final set of Basel reforms. To ensure that the implementation does not impair banks’ ability to finance growth and the economic transition to a sustainable economy, we need adequate and permanent solutions to cater for the specific way in which EU credit markets work. Any restrictions to banks’ lending capacity could turn out as counterproductive. As co-operative banks we are primary financing partners for SMEs and families. Finding balanced regulatory solutions is the way to ensure support to the real economy during their recovery for COVID.”

The EACB acknowledges the Commission’s efforts to reduce the expected impact of the reforms on the EU banking and credit markets and economy, while remaining compliant with the spirit of the global agreement, but further efforts are necessary. In particular, permanent solutions are needed to cater for the low-risk nature of certain exposures typical for EU credit markets. EU banks will face massive efforts adjusting to the new Basel standards. A 2025 start date and a sufficiently long period before all elements are fully phased-in are absolutely necessary, also in light of the uncertainty surrounding the implementation plans elsewhere.