OP Corporate Bank plc's Financial Statements Bulletin for 1 January–31 December 2020

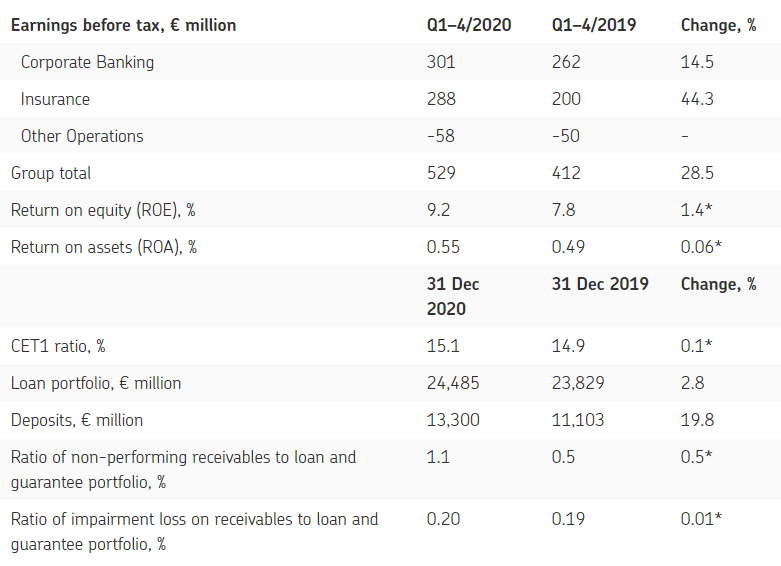

- Consolidated earnings before tax rose to EUR 529 million (412). Net insurance income increased by 38% to EUR 555 million (402) and net interest income by 10% to EUR 325 million (295). Transferring the rest of the management of the statutory earnings-related pension insurance to Ilmarinen Mutual Pension Insurance Company at the end of 2020 lowered the Group’s and the Insurance segment’s pension costs by EUR 85 million. Excluding the effect of the pension liability transfer, total expenses increased by 1% to EUR 641 million. The consolidated earnings were decreased by a fall of 41% in investment income to EUR 228 million (384).

- Corporate Banking earnings before tax increased by 15% to EUR 301 million (262). Net investment income increased by 22% to EUR 140 million (115) and net interest income by 3% to EUR 395 million (383). Corporate Banking earnings were weakened by an increase in expenses to EUR 231 million (220). Impairment loss on receivables totalled EUR 53 million (51). The loan portfolio grew in the year to December by 1% to EUR 24.0 billion (23.7).

- Insurance earnings before tax rose by 44% to EUR 288 million (200). Net insurance income increased by 38% to EUR 556 million (402). The reduction in the discount rate for insurance liability increased non-life insurance claims incurred by EUR 45 million (136). Investment income fell by 69% to EUR 75 million (242). The operating combined ratio improved to 87.8% (92.7).

- Other Operations earnings before tax were EUR –58 million (–50). Liquidity remained good despite the Covid-19 crisis.

- The Group’s CET1 ratio was 15.1% (14.9).

Comparatives deriving from the income statement are based on figures reported for the corresponding periods a year ago. Unless otherwise specified, balance-sheet and other cross-sectional figures on 31 December 2019 are used as comparatives.

*Change in ratio

Source:OP Financial Group