On February 13, 2018, the Supervisory Board of Groupe BPCE convened a meeting chaired by Michel Grass to examine the Group’s financial statements for the full year and fourth quarter of 2017. Those excellent results are showing the solidity of the Co-operative Banking modal !

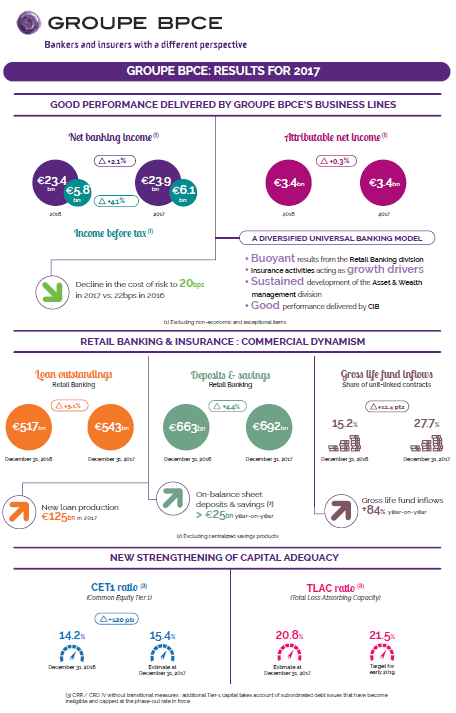

Francois Pérol, Chairman of the Management Board of Groupe BPCE, said: "The results for 2017 confirm the resilience of our universal banking model. The business lines of Natixis have again performed extremely well, in the area of both Asset & Wealth Management (revenues up by 14.5%) and Corporate & Investment Banking (+7.3%1). The Insurance and Payments activities have continued to enjoy strong growth and are confirming their role as true growth drivers for our Retail Banking and Insurance business lines. The commercial dynamism of our retail banking networks – which achieved record-breaking levels of new loan production worth 125 billion euros in 2017 overall – has made it possible to limit the unfavorable impact on our revenues created by low interest rates. Thanks to tightly managed growth in our expenses and a low cost of risk (at 20 basis points), the Group’s net income remains stable at 3.4 billion euros1. The Group’s balance sheet has been further reinforced, with high levels of both capital adequacy and total loss-absorbing capacity. Thanks to the strength of these results, the Group made an extremely positive start to its new TEC 2020 strategic plan."

For the full statement and more info about Groupe BPCE's results, please visit the dedicated WEBPAGE of their website.