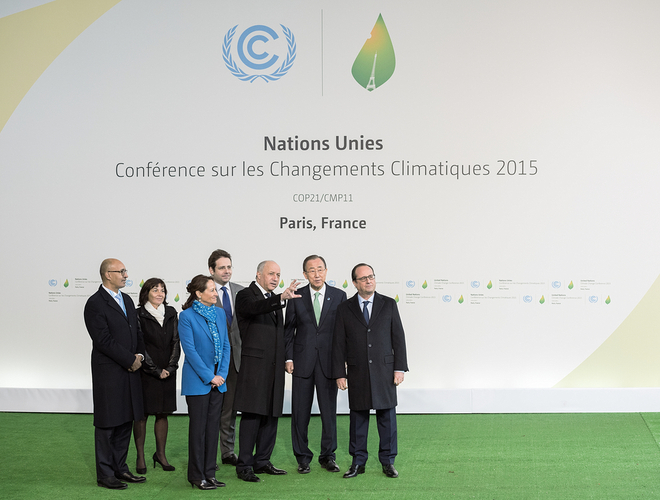

The European Association of Co-operatives Banks (EACB) together with eleven members signatories issued a statement addressed to the world leaders that are currently meeting in Paris during the United Nations Conference on Climate Change (COP21).

Co-operative Banks would like to reiterate their existing engagement in fighting global warming.

The full statement is available by clicking HERE.

Our objectives:

- reduce energy consumption,

- reduce emissions of greenhouse-effect gases,

- mobilise green financing,

- develop low carbon financing, etc.

The European Union is number one in the world when it comes to green financing through retail banks, in particular co-operative banks. The European co-operative banks consider continued global warming that overshoots agreed global limits as a severe risk to the environment; to food security for individuals and communities; to economies and to financial stability.

In this context local banks and co-operative banks have mobilised private funds to accelerate energy transition towards renewables and to fight against and limit climate change[1]. As part of this a number of co-operative banks have started to offer green products to their clients and members. With the support of local collectives, an initiative that began at regional level, has allowed SMEs and other businesses to develop dedicated markets related to energy transition and green growth.

These green market activities are increasing and becoming more profitable as production costs have fallen and the green energy market has become more competitive with traditional energy production ( ie fossil fuel etc). This transition phase could be speeded up and has the potential to offer a way both to stimulate economic growth and fight against global warming.

Co-operative banks would support the creation of an indicative framework to develop and foster the financing and investments of enterprises, households and small businesses, with development and implementation through dialogue at local level with co-operative and local banks. Given the importance of SMEs in the European economy, it is in the interests of all to develop solutions for low-carbon investment. Thanks to the dense network of SMEs in Europe, a substantial number of jobs could be created within local communities as a result. The local aspects of the fight against climate change will definitely play a great role in the success of the COP21 initiative.

Co-operative banks are ready to cooperate with the EU and international bodies, governments, NGOs, enterprises and households in order to develop a range of solutions that will help to address these challenges.

This statement reflects the existing engagement of co-operative banks in the fight against global warming. This general declaration is also in line with the commitment of co-operative banks to the United Nations Global Pact and the co-operative principles and values.

In this context, the EACB invites its members to support this statement and also to take part in its practical application

1 - Create a constructive and lasting dialogue among co-operative banks, governments and stakeholders.

We welcome the creation of an open and constructive dialogue, whether in connection with the organisation of COP21 or after the Conference. The objective of COP21 consists in building a long-term institutional relationship with the drafting of a new agreement in December 2015.

Such dialogue will provide the opportunity to highlight pioneering initiatives in the reduction of the carbon footprint of asset portfolios and to foster the mobilisation of the financial community as a whole.

2- Foster investment, financing and casualty insurance focused on low-carbon solutions and technologies.

Financing decisions and investments made today will play a major role in the transition towards a lower-carbon economy. It is essential to strengthen our ability to assess the implications of climate change and to seek to minimise its adverse effects, including the emission of greenhouse-effect gases

In particular, we consider that it is essential that co-operative banks:

- promote and develop their investments and investment offers integrating Environmental, Social and Governance (ESG) criteria, especially because members of the EACB already have historical expertise related to ESG financing, and management and are committed to the decarbonisation of their portfolios;

- promote the financing of their business and the products they offer with added environmental and social values, especially because certain members of the EACB already appear to be leaders in the Green Business;

- communicate with their clients/members, so that the climate may be better taken into account, especially because the members of the EACB are completing or strengthening their sectoral policies (corporate and retail investments, etc.)

3- Develop innovative solutions integrating the consequences of climate change.

In order to understand and adapt to the consequences of climate change and to reflect them, in particular in terms of risks and solutions, it is necessary to finance industrial innovation.

At the same time, the banking sector should also consider finance, insurance and investment solutions capable of supporting the development of cutting-edge technologies for their clients/members.

Such a preventative effort should be bolstered by a dynamic research and development policy, as witnessed by the initiatives taken by many co-operative banks’ asset management departments. The involvement of these units and their reinsurance specialists in climate change issues, and the assessment of their consequences, aim to better estimate future requirements of clients/members and propose to them an offer suited to climate-related risks[2].

4- Intensify the cooperation with and among co-operative banks and enterprises in order to reduce the threat and effects of climate change.

By working together, co-operative banks and their corporate clients may create an environment favourable to financing, insurance and investment, in order to better regulate the changeover to a low-carbon economy.

The EACB intends to invite its members to continue their dialogue with clients/members to encourage them to:

|

On the basis of their values, co-operative banks are resolutely committed to better financing the energy transition towards green growth.

[1] The global warming phenomenon has been clearly recognised in various international conferences on climate change since the Copenhagen negotiations. Since then banks such as Rabobank, Crédit Agricole, the Volksbanken, ( KfW) or la banque populaire have been involved.

[2] In the same regard, the Financial Stability Board (FSB) just proposed to G20 Leaders the setting up of an industry-led disclosure task force to develop voluntary, consistent climate-related disclosures of the sort that would be useful to lenders, insurers, investors and other stakeholders in understanding material risks. Further information available HERE or at http://www.financialstabilityboard.org/wp-content/uploads/Disclosure-task-force-on-climate-related-risks.pdf